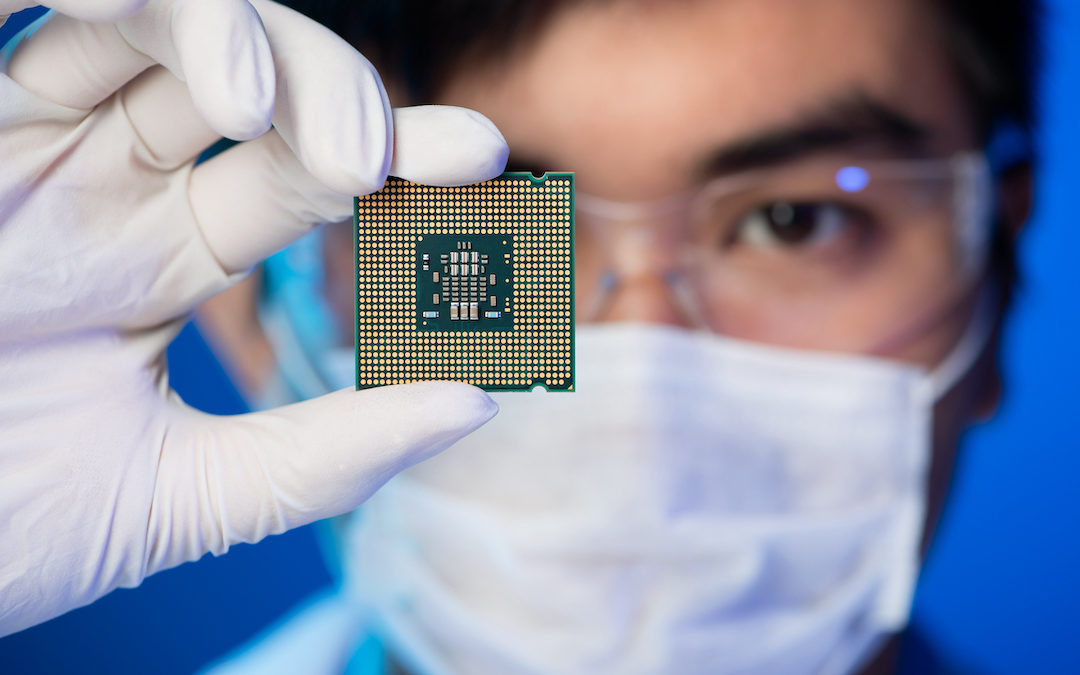

Toilet paper, lumber, and now … computer chips. That’s right; car companies and consumer electronics are duking it out over a tight supply of semiconductor chips, and some larger companies have been stockpiling chips as if they were packs of 3-ply Charmin in 2020. Obviously, the shortage of these parts used in notebook computers, smartphones, game systems, and cars is one that will be felt by consumers everywhere.

Why the Short Supply?

Since the pandemic began, consumers have stocked up on personal electronics. They’ve also bought more cars than the industry thought they would during the spring. On top of that, sanctions on Chinese tech companies are cutting off part of the supply. Limiting the supply even more, a fire at a Japanese chip-making factory (accounting for 30% of the global market car microcontroller units) halted production there. Production also temporarily halted at Samsung Electronics, NXP Semiconductors, and Infineon in Texas during Winter Storm Uri. All the factors combined have added up to a worldwide meltdown over computer chips now being referred to as “Chipaggedon.”

How Will This Affect You?

Carmakers have asked the U.S. and German governments to come to their aid. General Motors temporarily shut down three of its plants due to the shortage, and Ford Motors claims they’ll drop output by 20%. The shortage is expected to wipe out $61 billion in sales for automakers alone, but experts say the electronics industry could take a bigger hit. The crunch on the auto industry will affect supply for consumers and impact those who work for auto manufacturers.

With the demand for chips being so high, prices for smartphone components, including chipsets and displays, have risen as much as 15% in the past few months. Consumers can expect to see the price increase reflected in the price tag for personal electronics. They may also find products they want are out of stock, having to wait in line for new hardware, iPhones, Surface Pros, and Playstations. OEM manufacturers won’t be able to keep up with the demand for new hardware without enough of the parts they need.

How Long Will It Last?

Most tech leaders think the shortage will be around for a while. Cisco CEO Chuck Robbins said we’ll be feeling the effects for a couple of years since the demand for 5G technology will only increase and the switch to working from home isn’t going away anytime soon. It also takes a couple of years to build new chip-producing plants, which both Samsung and Intel have committed to doing. President Biden has said he’ll ask for $37 billion to increase chip manufacturing in the U.S. The industry and governments across the globe are responding, but unlike Harry Potter, they can’t fix this problem with a magic wand (Expelliarmus!).

That’s Shortages … with an S

Besides semiconductor chips, DRAM memory chips are also running low, but not as severely. Micron Technology Senior VP and CFO David Zinsner expects the DRAM shortage to continue throughout the year. Micron has almost a quarter of the DRAM memory market, and in December, an earthquake off the coast of Taiwan caused a power outage at two of their production facilities. The chipmaker had to suspend production for days, impacting its current available DRAM supply and causing another shortage.

Why Chipageddon Won’t Impact Inteleca

The chip shortage is yet another advantage to buying secondary hardware. Selling certified refurbished and surplus new items, we don’t need a slew of semiconductor chips to make and provide products. With an inventory of over $10 million in Inteleca-certified refurbished IT equipment that’s able to ship same-day, our customers shouldn’t have to wait for products. Additionally, for items not in stock, we’re able to source them from one of our hundreds of global partners and deliver them with a short lead time.

There has never been a better time to invest in secondary hardware! If you’re waiting in line for hardware, contact us to see how we can help.